When trading with a grid you do not usually experience realized losses, but you get floating drawdowns from time to time. Significant ones are usually rare, but it all depends on risks you set

You can set very high risks and lose the whole deposit in one go even on a small market movement or you can use lower risks and survive even another 2007-2009 financial crisis without a scratch

How to best deal with that? I usually recommend doing the following:

Imagine the biggest floating drawdown you can handle with the EA. Multiply that by 2. After that select risks level with which you did not have the historical drawdown exceeding this multiplied value

Why should you multiply the drawdown? Any trading system will eventually surpass the historical drawdown. Grid trading has a larger risks variability over time, so it needs this x2 margin to account for many things that will happen in the future that we don’t know yet

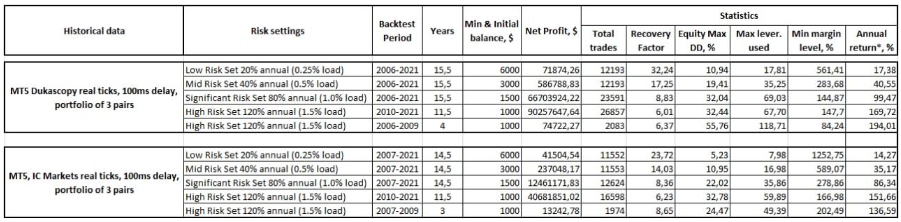

Below you can find the table with Waka Waka test results on high-quality tick data from different sources: