To engage in forex trading, you will need to open a trading account with a provider that offers online foreign exchange (FX) trading or CFD trading services.

These providers are commonly referred to as retail "forex brokers" or "CFD providers", and there are a few important aspects to consider when choosing one:

Leverage: In simple terms, leverage means having the power to control a significant amount of money by using only a small portion of your own funds and borrowing the rest.

Margins: Refers to the initial deposit of funds required by your broker as a "good faith" payment to open a trading position, typically expressed as a percentage of the total position value.

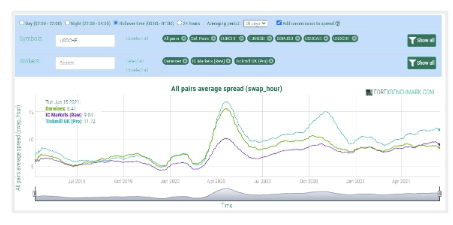

Spread: When dealing with currency pairs, brokers provide two prices: the bid and ask price. The bid price is the amount at which you can sell the base currency, while the ask price is the amount at which you can buy the base currency. The difference between these prices is called the spread.

Commission rate: In forex trading, the commission rate is usually a percentage calculated based on the total value of the trade.

Deposits and withdrawals: When dealing with forex brokers, it's crucial to be aware of additional fees that may be involved in trading. It's important to know these fees upfront before deciding to work with a particular broker. Hidden charges can often arise during key moments, such as making your initial deposit, making subsequent deposits into your account, or when withdrawing your profits as funds.

Regulations: Financial regulation involves imposing requirements, restrictions, and guidelines on financial institutions to ensure their proper functioning, while forex market regulation specifically governs the operations of firms in the forex industry to protect individuals from financial risk and fraud through ongoing oversight and enforcement of rules.

Currency pairs: Although there is a wide variety of currencies available for trading, only a select few receive significant attention and offer high liquidity. Apart from popular pairs like EUR/USD and GBP/USD, other major pairs include USD/JPY and USD/CHF. While brokers may provide an extensive range of forex pairs, it is crucial to ensure they offer the specific pairs that interest you as a trader.

Trading platforms: The trading platform serves as the gateway for investors to access the markets, making it essential for traders to ensure that a broker's platform and software provide the necessary technical and fundamental analysis tools. It is important that trades can be executed smoothly, allowing for easy entry and exit.

Customer service: Since forex trading operates around the clock, it's important to ensure that a broker's customer support is available 24/7. It's also worth considering how easily accessible live support personnel are. Making a brief phone call to a broker can provide insights into their customer service quality and typical response times.

All the aspects mentioned above are important, but the one that will affect your results the most when trading Forex as a retail trader, is spread.

To check the historical spreads of different Forex brokers for different currency pairs, you can use a free tool called ForexBenchmark: